How to Know When It’s Time to Outsource Your Bookkeeping

As a small business owner, you wear many hats—sales, marketing, customer service, and yes, bookkeeping. But at some point, DIY bookkeeping may start holding you back instead of helping you move forward. How do you know when it’s time to hand over the financial reins to a professional? Here are five key signs that outsourcing your bookkeeping might be the best move for your business.

1. You’re Spending Too Much Time on Bookkeeping

If you’re spending hours every week reconciling transactions, categorizing expenses, or trying to figure out financial reports, that’s time taken away from growing your business. Bookkeeping should support your business, not consume it. If it’s eating into the hours you could be spending on sales, strategy, or customer service, it’s time to outsource.

2. Your Books Are Always Behind (or a Mess)

Do you constantly find yourself scrambling at tax time? Are you months behind on reconciling your accounts? Falling behind on bookkeeping can lead to inaccurate financials, cash flow surprises, and missed tax deductions. A professional bookkeeper ensures your records stay updated, organized, and compliant.

3. You’re Making Business Decisions Without Clear Financial Data

If you’re unsure about your cash flow, profit margins, or financial trends, you’re essentially running your business blind. Quality bookkeeping provides the financial clarity needed to make informed decisions. If you don’t have up-to-date reports at your fingertips, outsourcing can provide you with accurate insights to guide your business strategy.

4. Tax Season Is Stressful and Costly

Scrambling to gather receipts and statements for your accountant every tax season? Filing your taxes shouldn’t be a last-minute rush. A professional bookkeeper ensures your records are in order year-round, reducing stress and possibly saving you money by maximizing deductions and avoiding penalties.

5. You’re Growing—and So Are Your Financial Needs

Growth is exciting, but it also brings financial complexity. More transactions, new employees, expanded services, or multiple revenue streams can quickly overwhelm a DIY system. A bookkeeper helps manage this growth by keeping everything organized and ensuring financial accuracy, so you can scale with confidence.

Is It Time to Outsource Your Bookkeeping?

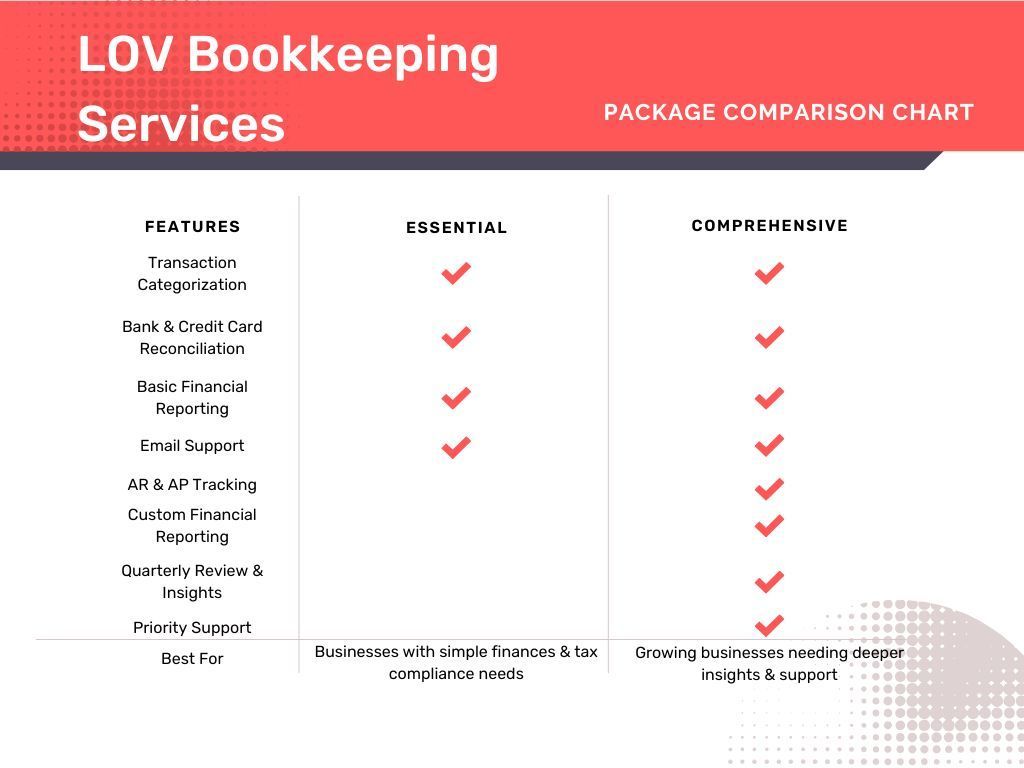

If any of these signs sound familiar, it may be time to consider outsourcing your bookkeeping. At LOV Bookkeeping, we help small business owners stay on top of their finances, freeing up time to focus on what they do best. Contact us today to see how we can support your business!