Blog

Articles

March 7, 2025

As a small business owner, you wear many hats—sales, marketing, customer service, and yes, bookkeeping. But at some point, DIY bookkeeping may start holding you back instead of helping you move forward. How do you know when it’s time to hand over the financial reins to a professional? Here are five key signs that outsourcing your bookkeeping might be the best move for your business.

February 7, 2025

As a small business owner, your ultimate goal is to grow and achieve success. While passion, hard work, and a great product or service are crucial, there's another critical component that often gets overlooked: accurate bookkeeping. Keeping precise financial records isn't just about staying organized—it plays a pivotal role in helping your business grow and thrive.

January 7, 2025

Introduction Bookkeeping might seem like a behind-the-scenes task, but it’s the backbone of any successful business. At LOV Bookkeeping, we know that well-organized, accurate financial records don’t just satisfy the IRS—they empower business owners to make smart, data-driven decisions. Whether you’re new to bookkeeping or looking to refresh your knowledge, understanding these basics can set your business up for lasting success.

November 12, 2024

Introduction The end of the year is the perfect time to get your finances in order and set up for a smooth start in the new year. By closing out your books correctly, you ensure accuracy in your records and make tax season far less stressful. Some businesses experience a bit of a slowdown starting in late November and through the rest of the year as people start taking time off for the holidays. This is a perfect opportunity for you to focus on cleaning up your books and getting your accounts in order.

October 2, 2024

For real estate professionals, managing finances can be just as crucial as closing deals. Whether you’re a broker, property manager, or real estate investor, maintaining a solid financial foundation is essential to growing your business and sustaining profitability. Here are three common financial challenges and how you can address them to improve your bottom line. 1. Cash Flow Management One of the biggest challenges for real estate professionals is managing cash flow, especially when dealing with inconsistent income streams. For example, property managers may experience gaps in rental income due to vacancies, and real estate agents often deal with fluctuating commission payments. Creating a detailed cash flow plan can help you anticipate these fluctuations and set aside funds during high-income months to cover leaner times. 2. Expense Tracking It’s easy to lose track of day-to-day business expenses, but poor tracking can lead to financial inefficiencies and missed tax deductions. Implementing a system to categorize expenses—such as office supplies, marketing, and property maintenance—will ensure you know where your money is going and help you maximize deductions at tax time. 3. Tax Planning Real estate professionals often face complex tax scenarios. Regular tax planning is vital to minimizing your tax liability while remaining compliant with local regulations. Work with a bookkeeper or accountant who understands the real estate industry to ensure you're making the most of tax deductions like property depreciation and mortgage interest. By addressing these challenges head-on, real estate professionals can set their businesses up for long-term success. Need help? Reach out to us for customized bookkeeping solutions!

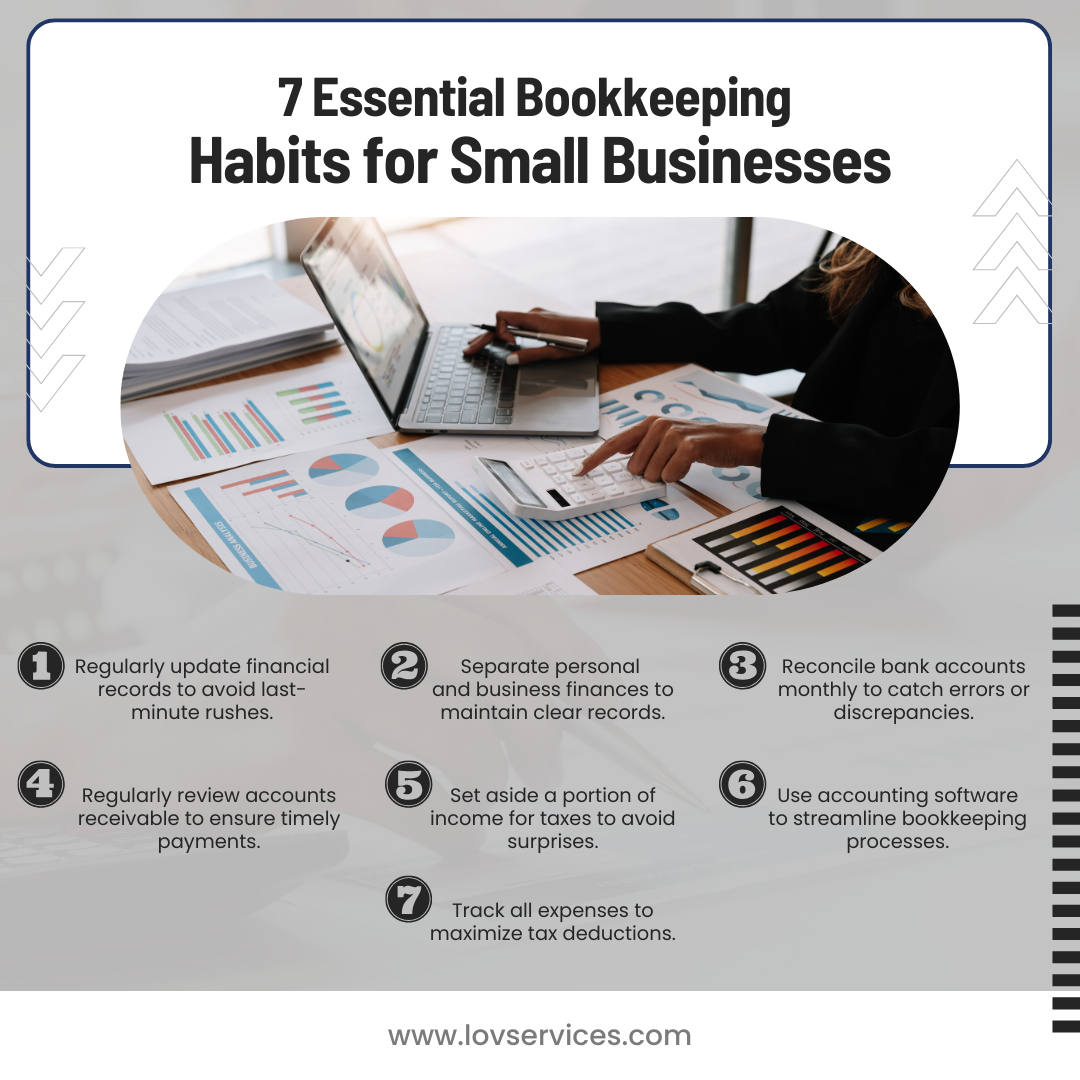

July 22, 2024

Maintaining accurate and up-to-date bookkeeping is essential for the success of any small business. As a small business owner, it's crucial to develop good bookkeeping habits to ensure the financial health of your company. Here are seven essential bookkeeping habits that every small business should adopt: Regularly update financial records: Avoid the last-minute rush by making a habit of updating your financial records on a consistent basis, whether it's daily, weekly, or monthly. This will help you stay on top of your finances and make informed decisions. Separate personal and business finances: It's important to keep your personal and business finances completely separate. This will make it easier to track expenses, generate accurate financial reports, and ensure compliance with tax regulations. Reconcile bank accounts monthly: Make it a habit to reconcile your bank accounts on a monthly basis. This will help you catch any errors or discrepancies early on, preventing larger issues down the line. Review accounts receivable regularly: Stay on top of your accounts receivable by reviewing them regularly. This will help you identify any late payments or outstanding invoices, allowing you to take prompt action to collect the owed funds. Set aside a portion of income for taxes to avoid surprises. Similar to having an emergency fund, this will help you to make sure you can cover your tax payments without having to resort to borrowing. Use accounting software to streamline bookkeeping processes. If you’re small enough, you may be able to do your books on excel or with receipts, but most small businesses should have accounting software that matches their needs. Track all expenses to maximize tax deductions. If you’re already practicing habits 1 thru 6, this should be happening. However, it’s worth a special mention here! By adopting these seven bookkeeping habits, you'll be well on your way to maintaining a strong financial foundation for your small business, allowing you to focus on growth and success. At LOV bookkeeping, we work with small business owners to make sure they have these processes in place and they are being followed. We can take care of the heavy lifting here while you focus on doing the things that help grow your business.

May 20, 2024

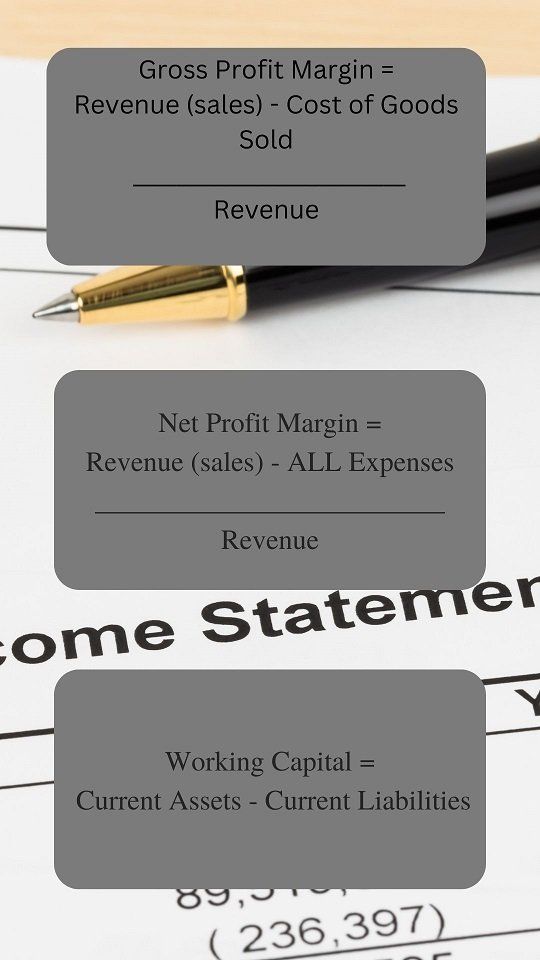

Financial KPIs (Key Performance Indicators) are essential metrics that provide invaluable insights into the financial health and performance of a business. By closely monitoring and analyzing these KPIs, business owners and leaders can make informed decisions that drive growth, optimize operations, and ensure long-term sustainability. One of the primary reasons why financial KPIs are so important is that they offer a clear and objective way to measure the financial performance of a company. These metrics can help identify areas of strength, as well as areas that require improvement, allowing businesses to allocate resources more effectively and make strategic adjustments as needed. When it comes to financial KPIs, there are several key areas that businesses should focus on, including revenue, profitability, liquidity, and efficiency. Revenue-based KPIs, such as total revenue, revenue growth, and customer acquisition cost, provide insights into a company's ability to generate income. Profitability KPIs, like gross profit margin and net profit margin, reveal the company's ability to convert revenue into profit. Liquidity KPIs, such as current ratio and quick ratio, indicate a business's ability to meet its short-term financial obligations. Efficiency KPIs, like inventory turnover and accounts receivable turnover, showcase how effectively a company is utilizing its resources. Three of these KPI’s are listed below with their respective formulas. As always, before you can begin to track KPI’s you have to have good financial data and reports. That is the foundation for being able to efficiently track performance. By closely monitoring and analyzing these financial KPIs, businesses can make informed decisions, identify areas for improvement, and ultimately drive long-term success and growth.

By Alexander R Li

•

April 24, 2024

I recently gave a presentation clarifying the different roles of a CPA, Accountant, and Bookkeeper. For most people this can be a confusing subject and even I struggle sometimes with trying to define the lines the divide them. Suffice it to say that all tend to venture into each others space and there is some overlap. However, today I want to focus on what value a good bookkeeper can bring to your business. If you are trying to grow, focusing on generating more revenue, the last thing you want to do is lose momentum while trying to figure out the accounting for your business. So, find a good bookkeeper, like us, who can help you! Here is a short list of some areas that bookkeepers can help: They Save you time - Unless you are a bookkeeper, you’re probably spending too much time doing it. They Track transactions and receipts - A bookkeeper should be able to help you set up systems and processes to keep track of your receipts in case you need to present them in the future, such as in an audit situation. They help to Reduce errors - Categorization errors are the biggest issue when it comes tax time. If you are entering transactions incorrectly, this can cause major problems for your business. They assist in Financial statement preparation - Financial statements tell the story of how your business is doing financially. Banks, shareholders, and other outside parties will be very interested in these statements. The balance sheet shows the book value of a business. The income statement shows a business’s earnings over a given period of time. The cash flow statement shows how the company is financing their operations; where cash is coming from and where it’s going. A client that I had been working with for 3 years, decided to sell her company. We focused our bookkeeping efforts and advice on those areas that add value from an accounting standpoint when selling a business, profit. She was able to sell for an amount she was happy with upon closing and when she starts her next venture, we’ll be there to help!

February 13, 2024

Having clean accounting records is crucial as it enables businesses to keep track of their income, expenses, assets, and liabilities in a systematic manner. This ensures transparency and reduces the risk of errors or misinterpretations that could lead to financial discrepancies or legal issues. Accurate financial statements are a reflection of a company's performance and help stakeholders make informed decisions. They provide an overview of revenue, expenses, profits, and losses over a specific period. With reliable financial statements in place, businesses can confidently communicate their financial position to investors, lenders, and other interested parties. Organized bookkeeping is another vital aspect that contributes to effective financial management. By maintaining well-organized records of transactions such as invoices, receipts, and bank statements in a systematic manner, businesses can easily track their cash flow activities. This not only simplifies day-to-day operations but also streamlines auditing processes or future reference needs. Efficient tax preparation is essential for any business looking to minimize its tax liability while remaining compliant with tax laws. By keeping accurate records throughout the year and staying up-to-date with changes in tax regulations, companies can identify eligible deductions or credits that can help reduce their overall tax burden. Additionally, efficient tax preparation ensures timely filing of returns without last-minute rushes or penalties. Step-by-Step Guide to Cleaning Up Your Accounting Records Gather and Organize All Financial Documents and Receipts Review and Reconcile Bank Statements and Credit Card Statements Categorize Expenses Correctly for Accurate Reporting Check for Any Errors or Discrepancies in the Books Create a System for Documenting and Storing Financial Records Going Forward It’s a lot! We get it, but you don’t have to do it alone. We are here to help. Go to our Consultations page today and schedule a 30 minute meeting to see if we are a good fit to help you take your company to the next level!