Cash is NOT always King

In a society where cash has traditionally been considered king, a shift in mindset needs to occur. Many online businesses operate with "cash up front" and individuals and businesses need to recognize the potential liabilities associated with spending before earning.

The idea of spending before earning can create financial strain and uncertainty. It can lead to increased debt, limited cash flow, and a lack of financial flexibility. By relying on cash up front, individuals and businesses may find themselves constrained by their current resources and unable to pursue growth opportunities.

It's important to note that this does not mean that cash is no longer valuable or necessary. Cash is vital in our economy and serves as a medium of exchange for goods and services. It provides immediate purchasing power and can be essential for emergencies or unexpected expenses.

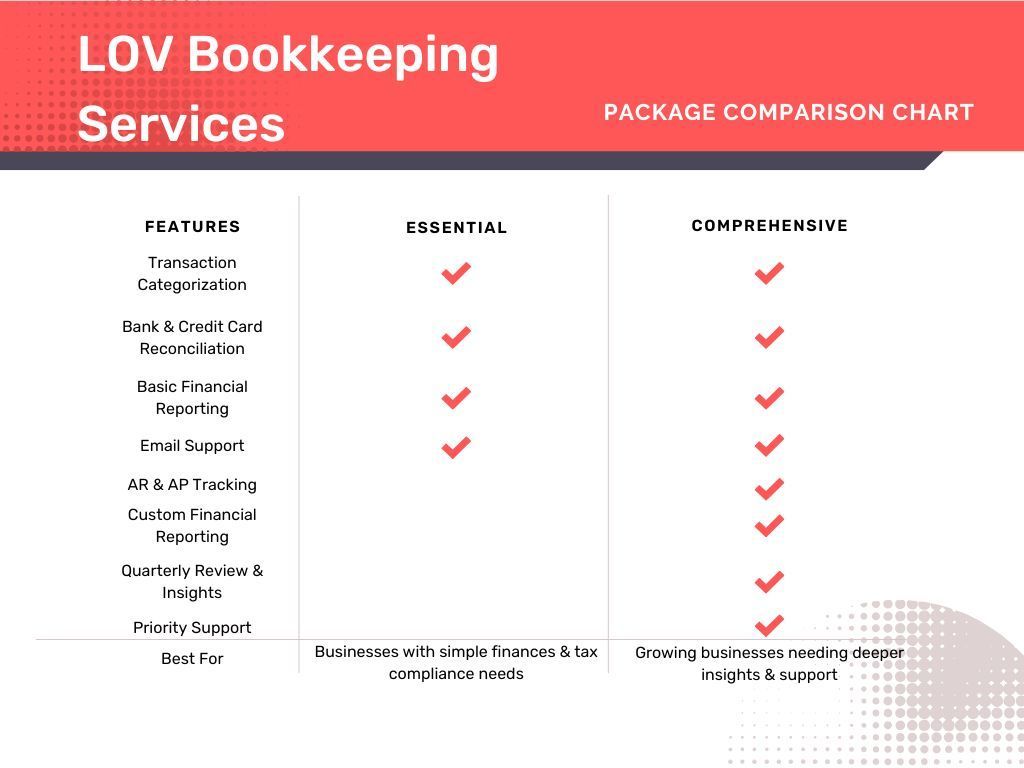

Instead, the shift lies in recognizing the importance of balancing cash flow with long-term financial stability. Rather than using cash deposits, or the “cash up front”, consider alternative financing options such as loans or lines of credit. In this way, individuals and businesses can strategically manage their expenses while still maintaining control over their finances.

I recently spoke with a small business owner who operated an online dropship website. Their customers would purchase online, pay immediately, and then the business would order from a supplier and pay in the future. During the supply chain problems of 2020, they were taking orders as usual, but the suppliers were not delivering on time and sometimes not at all. So cash was very strong. After some time customers began cancelling orders. So these customers were expecting to get their money back. However, this business owner was using that cash to fund their lifestyle. Long story short, they had to declare bankruptcy and shut down the business.

Ultimately, the idea that "cash may not be king" highlights the need for thoughtful financial planning and decision-making. It encourages us to consider the potential risks and benefits associated with spending before earning, ensuring that we strike a balance between immediate needs and long-term financial health.